The emerging advanced technologies such as machine learning, deep learning and others are expected to affect entire landscape of insurance sector, thus, creating lucrative growth opportunities for InsurTech companies. Insurance carriers are striving to create a digital environment through innovation in traditional offerings to retain customers, improve efficiency and reduce costs. Self-service platforms are at the core of this transformation which enable insurers to divert workforce from cumbersome repetitive tasks to other operations and delivers fast services to customers. InsurTech companies are using advanced technologies, including artificial intelligence to further enhance the capabilities of these self-service platforms and other solutions in their product portfolio for applications such as underwriting, customer service, claims management, marketing and fraud detection. The success of artificial intelligence technologies in insurance sector has been facilitated owing to the massive amounts of data generated, which has enabled the artificial intelligence algorithms to learn from these huge datasets and increase their maturity for any possible scenario. This has encouraged multiple InsurTech providers to incorporate these technologies in their offerings. For instance, Analyze Re of Verisk Analytics, a Software as a Service (SaaS) platform, provides real-time reinsurance analytics using machine learning to improve the pricing and portfolio management of reinsurance contracts. Zurich Insurance introduced artificial intelligence powered personal injury claims handling tool in 2017. Similarly, Aviva Life Insurance, VisitorsCoverage Inc. and other companies are using artificial intelligence based chatbots for marketing and customer experience applications. The InsurTech solution vendors are also developing differentiated solutions to cater to these changing requirements. As an instance, Cognizant launched an artificial intelligence platform in September 2019, which provides the insurance vendors the ability to process large numbers of property insurance claims occurring in natural disasters or other catastrophic events. Thus, the increasing number of artificial intelligence based solutions and their subsequent adoption by insurance providers is propelling the growth of global InsurTech market.

Request for Sample Copy of This Report@ https://www.absolutemarketsinsights.com/request_sample.php?id=609

The recent outbreak of COVID-19 pandemic has positively impacted InsurTech market across the globe. The crisis situation has encouraged insurance companies to adopt digitization strategies to ensure that high quality of services are delivered to customers owing to the significant strain on sales and service processes in insurance industry. In June 2020, AIA Group Limited announced the ramping up of their adoption of digitization and robotic process automation technologies in their effort to respond to the coronavirus crisis with innovation and agility and cater the new age tech-savvy customers. Thus, the digitization strategies of insurance providers to cope with coronavirus crisis are anticipated to boost the growth of global InsurTech market over the period of next eight years.

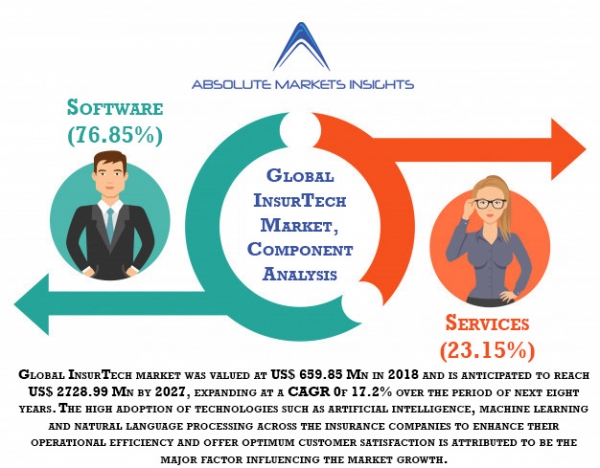

In terms of revenue, global InsurTech market was valued at US$ 659.85 Mn in 2018 and is anticipated to grow at a CAGR of 17.2% over the forecast period. The study analyses the market in terms of revenue across all the major regions, which have been bifurcated into countries.

Enquiry Before Buying @ https://www.absolutemarketsinsights.com/enquiry_before_buying.php?id=609

The detailed research study provides qualitative and quantitative analysis of InsurTech market. The market has been analyzed from demand as well as supply side. The demand side analysis covers market revenue across regions and further across all the major countries. The supply side analysis covers the major market players and their regional and global presence and strategies. The geographical analysis done emphasizes on each of the major countries across North America, Europe, Asia Pacific, Middle East & Africa and Latin America.

Key Findings of the Report:

- The global InsurTech market was valued at US$ 659.85 Mn in 2018 and is anticipated to witness a compound annual growth rate of 17.2% over the forecast period owing to the emergence of connected insurance and other innovative business models.

- Based on component, cloud based software are witnessing high preference from the insurance providers owing to the faster launch new products and savings of cost incurred in infrastructure development.

- Large enterprises dominate the global InsurTech market owing to their high expenditure power on innovative offerings.

- North America held the highest market share in global InsurTech market in 2018. Asia Pacific is expected to register the highest compound annual growth rate (CAGR) over the period of next eight years. Increased investments by the market participants along with the strategic initiatives being undertaken in the region are estimated to fuel the market growth.

- Some of the players operating in the InsurTech market are Accenture, Capgemini, Cognizant, DXC Technology Company, IBM Corporation, Infosys Limited, Insurity, Inc., Microsoft, Mindtree Ltd, Oracle, Quantemplate, SAP SE, SAS Institute Inc., Shift Technology, Slice Insurance Technologies Inc., Tata Consultancy Services Limited, Tr?v, Inc. and Verisk Analytics amongst others.

Request for Customization@ https://www.absolutemarketsinsights.com/request_for_customization.php?id=609

Global InsurTech Market:

- By Component

- Software

- Cloud Based

- On Premise

- Services

- Software

- By Application

- Claim Management

- Fraud Detection

- Underwriting

- Marketing and Customer Experience

- Others

- By Insurance Type

- Individual Insurance

- Business Insurance

- Reinsurance

- By Organization Size

- Small and Medium Sized Enterprises

- Large Enterprises

- By End Users

- Insurance Companies

- Agents and Brokers

- Aggregators

- By Region

- North America

- U.S

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- Middle East and Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- North America

Get Full Information of this premium report@ https://www.absolutemarketsinsights.com/reports/Global-InsurTech-Market-2019-2027-609

About Us:

Absolute Markets Insights assists in providing accurate and latest trends related to consumer demand, consumer behavior, sales, and growth opportunities, for the better understanding of the market, thus helping in product designing, featuring, and demanding forecasts. Our experts provide you the end-products that can provide transparency, actionable data, cross-channel deployment program, performance, accurate testing capabilities and the ability to promote ongoing optimization.

From the in-depth analysis and segregation, we serve our clients to fulfill their immediate as well as ongoing research requirements. Minute analysis impact large decisions and thereby the source of business intelligence (BI) plays an important role, which keeps us upgraded with current and upcoming market scenarios.

Contact Us:

Company: Absolute Markets Insights

Email id: [email protected]

Phone: +91-740-024-2424

Contact Name: Shreyas Tanna

The Work Lab,

Model Colony, Shivajinagar, Pune, MH, 411016

Website: https://www.absolutemarketsinsights.com/