The market for loans has been a notable proponent for growth observed in the financial services sector. Governing authorities across various countries have studied and advocated the importance of financial lending for the upliftment of the economy in their operating regions. The concept and processes pertaining to financial lending has been observed to have reinvented over the years in order to improve the effectiveness of the lending practices and in turn, the revenue generated by the financial institutions. The development of lending processes has also been observed to have occurred owing to the widening of the user base related to the finances provided by the banking and non-banking financial institutions. A notable development in the lending processes is seen to be the digitization of the various procedures used by financial institutions in their operations. The adoption of digital lending platforms is a notable addition to the digital arsenal of the financial sector in order to facilitate their users with several funding options with minimal physical documentation and interactions. These platforms are observed to help in optimizing the processes across the loan origination, documentation up to the loan disbursal stage. These factors and the feature sets from the market offerings have been responsible for the growing awareness regarding the solutions offered by various companies in the global digital lending platforms market.

Request for Sample Copy of This Report@ https://www.absolutemarketsinsights.com/request_sample.php?id=798

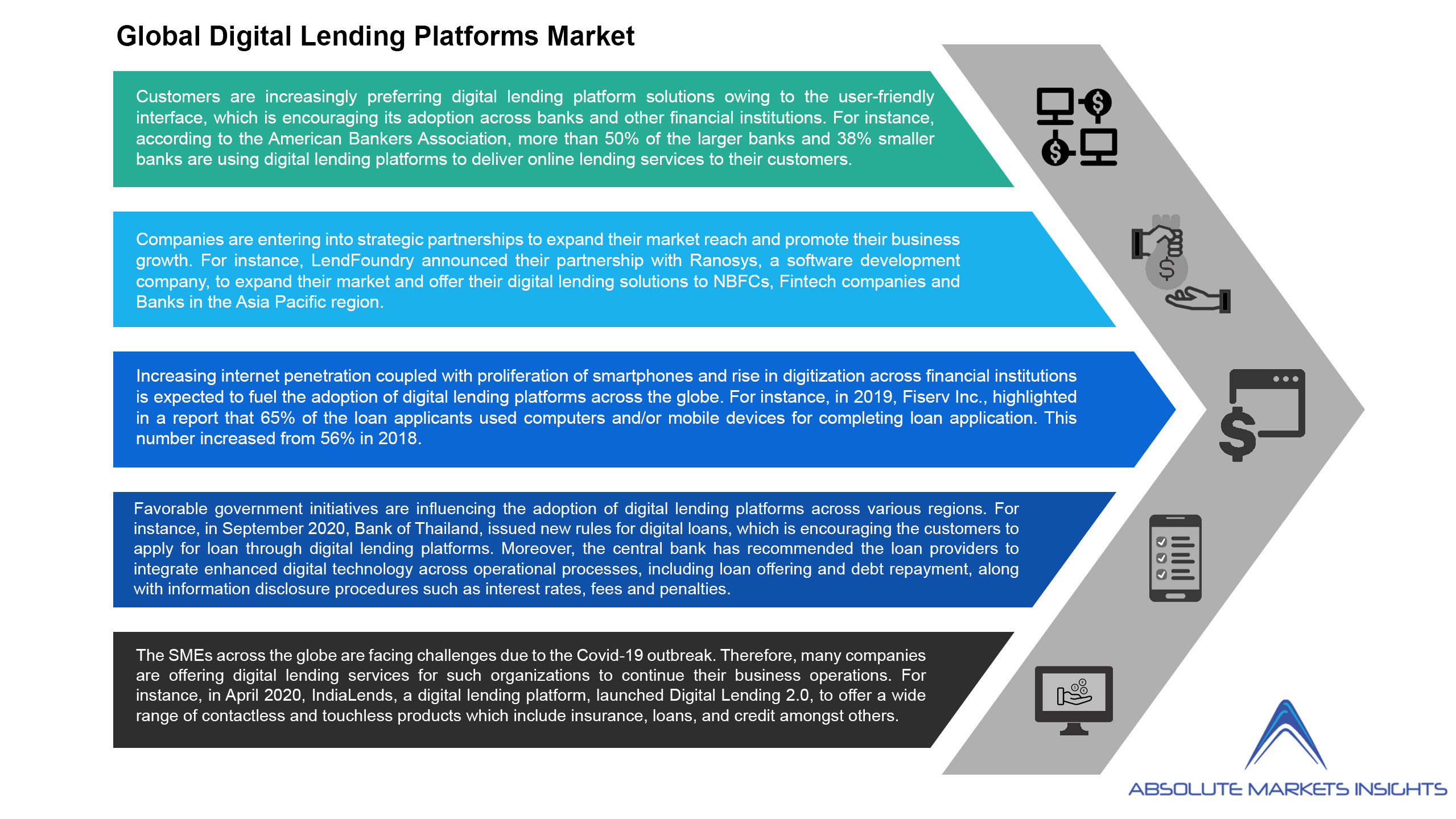

The outbreak of the novel coronavirus has created an adverse impact on the financial services industry on the global scale. Traditional forms of service delivery in the sector have been impacted, leading to losses. The companies in the financial services industry have been observed to utilize technological tools in order to increase the expanse of their operational areas and reach a wider customer base through this adoption. The use of digital lending platforms has allowed financial institutions to undertake the various processes in the lending journey without any contact with the customer and in an optimal manner. It is also expected that the trend would extend over the near future with more financial institutions targeting the use of digital lending platforms for enhancing the revenue generation capabilities across their operations, and hence showcases positive growth trajectory for digital lending platforms market in the coming years.

Global digital lending platforms market was estimated to be US$ 5785.24 Mn in 2019 and is expected to grow at a CAGR of 16.25% during the forecast period (2020-2028). The study analyses the market in terms of revenue across all the major regions, which have been bifurcated into countries.

The detailed research study provides qualitative and quantitative analysis of digital lending platforms market. The market has been analyzed from demand as well as supply side. The demand side analysis covers market revenue across regions and further across all the major countries. The supply side analysis covers the major market players and their regional and global presence and strategies. The geographical analysis done emphasizes on each of the major countries across North America, Europe, Asia Pacific, Middle East & Africa and Latin America.

Enquiry Before Buying @ https://www.absolutemarketsinsights.com/request_sample.php?id=798

Key Findings of the Report:

- The offerings in the digital lending platforms market are classified majorly into solutions and services. Lending providers are observed to be procuring solutions for digital lending on a large scale. Development of solutions has been observed to occur with more focus on encompassing the various processes related to loan provision. Services provided by the market participants are focused on consulting and analytics services, to customize solutions in accordance with the specific requirements of the end users. Furthermore, the adoption of support services is observed to be growing at a steady rate over the recent years. These factors are expected to propel the digital lending platforms market towards sustained growth.

- The procurement of loans is observed to have grown over the years owing to various efforts from financial service providers related to reducing the barriers for loan procurement along with initiatives from governing authorities for creating a financial system wherein loans can be easily procured. This trend is observed to be prevalent for the consumer and commercial lending sector, which has encouraged the financial service providers to strengthen their infrastructure for an optimized lending process. These factors have been responsible for the growing adoption of digital lending platforms from various end users.

- The adoption of digital lending platforms has been observed to have grown in the recent years owing to the rapid shift towards digitization across the financial sector. Countries in the region of North America have been observed to be at the forefront in terms of technological adoption across a wide range of industry verticals. This trend is also observed to have trickled down to the adoption of digital lending platforms across the financial services industry. The demand for solutions and services in digital lending platforms market is observed to grow owing to the collaborations from market participants and end users for devising optimal market offerings. Furthermore, countries in the Asia Pacific region are observed to become a notable venture for the financial services industry, and facilitate the growth of digital lending platforms market over the next eight years.

- The major players operating in the digital lending platforms market are Abrigo, Blend, CU Direct, Ellie Mae, Inc., First American Financial Corporation (Docutech), FIS, Fiserv, Inc., Intellect Design Arena Ltd, Juris Technologies Sdn Bhd, Mambu, Newgen Software Technologies Limited, Nucleus Software Exports Ltd., Pegasystems Inc., Roostify, Sigma Infosolutions (LendFoundry), Tavant and Temenos Headquarters SA, among others.

Request for Customization@ https://www.absolutemarketsinsights.com/request_for_customization.php?id=798

Global Digital Lending Platforms Market:

- By Offerings

- Solutions

- Services

- Implementation Services

- Advisory & Consulting Services

- Support Services

- Others

- By Type

- Integrated

- Standalone

- Loan Origination

- Loan Servicing

- Debt Management

- Consumer Engagement & Aggregation

- Credit Reporting

- Risk and Compliance Management

- Document Management

- Others

- By Deployment

- On Premise

- Cloud Based

- By Application

- Consumer/Personal Loan

- Corporate Lending

- SME Lending

- Agriculture Lending

- Residential Lending

- Automotive Loan

- Working Capital Funding

- Others

- By Organization Size

- Small and Medium Enterprises

- Large Enterprises

- By End Users

- Banks

- Insurance Companies

- Credit Unions

- Peer-to-Peer (P2P) Lending

- Others

- By Region:

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Get Full Information of this premium report@ https://www.absolutemarketsinsights.com/reports/Digital-Lending-Platforms-2020-%E2%80%93-2028-798

About Us:

Absolute Markets Insights strives to be your main man in your business resolve by giving you insight into your products, market, marketing, competitors, and customers. Visit …

Contact Us:

Email id: [email protected]

Contact Name: Shreyas Tanna

Phone: +91-740-024-2424