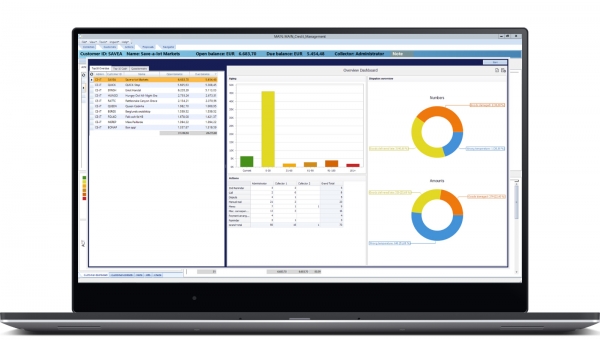

Over the past decade, credit management is evolving into a data-driven function that is driven by artificial intelligence, robotic processes, advanced scoring analytics, and automated workflow that eliminates most of the manual tasks and duties previously performed. Digital solutions have transformed the workplace, and with SaaS applications being available anytime anywhere all users thus share information. Hence, these solutions have proven to be suitable for credit risk management. As these applications can be deployed on several sites worldwide, they allow data to be shared between the head office of a company and its different subsidiaries and between all the relevant parties within the organization. The analysis of financials, social credit group meetings, reference calls, faxes, emails, and never-ending follow-ups are all being replaced by automation and workflow systems. Technology innovation has brought sales, credit, and the customer into a common platform where information and business functions are done with one entry and a click. Virtual credit networks have exponentially expanded now to trade data without the need to travel for in-person group meetings. On the other hand, credit managers, are using automated tools instead of the manual workforce to accomplish their goals. Such factors are pushing the adoption of credit management software market.

Request for Sample Copy of This Report@ https://www.absolutemarketsinsights.com/request_sample.php?id=28

Banking and finance companies are increasingly focusing on switchable credit risk policies which can help the company to control the risk in real-time and therefore to enhance its visibility. Smart automated software has aided in this calculation by assessing the capacity of commercial partners to meet their commitments, limit risks and thus protect turnover. Likewise, companies are utilizing this technology for risk anticipation, regulation, and negotiation that has to be implemented from the initial sale through cash collection. The intervene of technology has proven to be a successful venture, as companies can limit the number and scope of possible disputes, secures better cash flow, establish profitable and maintainable margins as well as achieve conflict resolution processes, thus driving the growth of credit management software market.

Current innovation, particularly solutions that have been made available in cloud, has brought more transparency and pro-activity to credit risk management. The solutions support a collaborative workspace that can help to automate customer monitoring, manage KPIs in real-time, and circulate information. The proliferation of smart devices and remote servers has created efficient means to implement a controlled risk management policy. Cloud technology has allowed companies to host data and software on remote servers while guaranteeing service continuity and quality. It has supported the company to adopt customized workflows, delivering applications that can be accessed from anywhere, anytime. Based on the level of clearance, all employees have access to updated and reliable information. Cloud-based credit management solution has a genuine competitive advantage over on-premise installation, as it allows the rapid, simple, and reliable launch of strategic applications. Based on studies, 78% of organizations have adopted at least one cloud-based service. With an annual increase of around 20% cloud computing is now achieving mainstream deployment across the globe. Hence, these factors has pushed the adoption of cloud based credit management software market across the globe.

Enquiry Before Buying @ https://www.absolutemarketsinsights.com/enquiry_before_buying.php?id=28

The detailed research study provides qualitative and quantitative analysis of the global credit management software market. The credit management Software market has been analyzed from demand as well as supply side. The demand side analysis covers market revenue across regions and further across all the major countries. The supply side analysis covers the major market players and their regional and global presence and strategies. The geographical analysis done emphasizes on each of the major countries across North America, Europe, Asia Pacific, Middle East & Africa and Latin America

Request for Customization@ https://www.absolutemarketsinsights.com/request_for_customization.php?id=28

Global Credit management Software Market

- By Deployment Type

- Cloud based

- On-premises

- By Service Type

- Consulting

- Operation & Maintenance

- System Integration

- By Organization Type

- Small and Medium Enterprises

- Large Enterprises

- By Region:

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Get Full Information of this premium report@ https://www.absolutemarketsinsights.com/reports/Credit-Management-Software-Market-2018-2026-28

About Us:

Absolute Markets Insights strives to be your main man in your business resolve by giving you insight into your products, market, marketing, competitors, and customers. Visit …

Contact Us:

Email id: [email protected]

Contact Name: Shreyas Tanna

Phone: +91-740-024-2424