Search result for shale

The Forecast of the United States Shale Oil and Gas

Earth scientist David Hughes has released a new report, Shale Reality Check 2021, on the future of shale oil and gas in the United States.

The report presents the reality of the U.S. Energy Information Administration’s (EIA) forecasts for the future of oil and natural gas from sha...

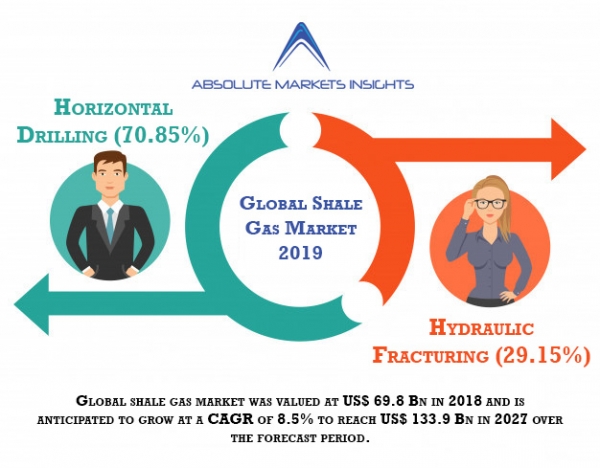

Covid-19 Update: Global Shale Gas Market is valued at US$ 69.8 Bn and is expected to grow at a CAGR of 8.5% over the Forecast Period, Owing to Growing Production Coupled of Shale Gas Coupled with Price Drop in Industry, says Absolute Markets Insights

Global shale gas market was valued at US$ 69.8 Bn in 2018 and is anticipated to grow at a CAGR of 8.5% to reach US$ 133.9 Bn in 2027 over the forecast period. Rise in the production of shale gas around the world is anticipated to create good opportunities for multiple end-use industries over the ...

RUSSIA AND SAUDI OIL WAR COULD BENEFIT SHALE GAS INDUSTRY, SAY OIL ANALYSTS

Highlights:

- The oil price war between Saudi Arabia and Russia could hurt American shale oil and gas companies.

- However, this oil war may benefit the shale gas industry in Pennsylvania, according to a senior analyst at S&P Global Platts.

AMERICAN SHALE GAS SATISFIES JAPANESE ENERGY REQUIREMENTS POST NUCLEAR DISASTER

Highlights:

- 2011’s nuclear disaster meant Japan had to close down 54 nuclear power plants

- Japanese people sought energy sources at the global level to meet the country’s energy needs

The foreign tankers at Japanese ports ...

RUSSIA-SAUDI ARABIA OIL PRICE WAR MAY BANKRUPT THE US SHALE INDUSTRY

Highlights:

- Saudi Arabia and Russia: oil production cut fall out

- Saudi Arabia sells oil cheaper to Asian and other countries

- US shale market plummets

- Shockwaves in the shale industry.

A l...

COVID-19 CRISIS CASTS AN EVEN DARKER SHADOW OVER THE WEAKENING OIL AND GAS INDUSTRY

Highlights:

- Oil prices plunged into yet another bear market in response to sudden demand destruction caused by factory shutdowns, flight cancellations, and slowdowns in air passenger traffic.

- Experts determined that natural gas is sitting near a four-...

MAJOR OIL COMPANY TO CUT JOBS IN THE FACE OF SHARP OIL AND GAS PRICE DROPS

Highlights:

• Chevron Corp is reportedly offering buyouts to decrease its workforce in the U.S. oil exploration and production plants.

• The major oil business is swiftly moving in to reduce costs in the face of a sharp decline in natural oil and gas...

SAUDI ARAMCO ANNOUNCES US $100 BILLION INVESTMENT IN LATEST SHALE PROJECT

Highlights:

- Saudi Aramco is the world’s biggest energy company owning a production clip of over 10 million barrels per day of oil.

- Aramco is also responsible for single-handedly pumping over 10% of the global crude supply at the lowest productio...

U.S LNG'S MAJOR CONSUMER REMAINS TO BE JAPAN

Highlights:

- Japan is the highest importer of LNG in the global market

- U.S exports it’s third highest quantity to Japan

Japan is highly dependent on fossil fuels. The country has remained at the top spot of global importers of l...

EXPERTS FORECAST AN INEVITABLE SHALE DECLINE AS OIL PRICES REACH ALL-TIME LOW

Highlights:

• The U.S. shale industry continues to show signs of rapidly slowing down over the weeks.

• Production declining in major shale basins outside of the Permian reported by sources.

- Overwhelming economic st...

Chevron (CVX) reports $20 billion in equity, exploratory budget; see $10-$11 billion in Q4 impairment charges in Part Because of the shale of Appalachia

Today, Chevron Corporation (NYSE: CVX) reported a $20 billion plan of organic capital and exploratory investment in 2020. The 2020 plan supports a diverse portfolio of upstream and downstream projects, demonstrated by the world-class position of Chevron's Permian Basin, TCO's largest cons...